What is CO₂ compensation?

CO₂ compensation is a reduction or removal of carbon dioxide or other greenhouse gas emissions to offset emissions elsewhere. Offsets are measured in tons of carbon dioxide equivalent (CO₂e). One ton of carbon offset represents the reduction or removal of one ton of carbon dioxide or its equivalent in other greenhouse gases.

Both the Oxford Principles for Net Zero Aligned Offsetting and the Net-Zero Criteria of the Science Based Targets initiative advocate for going beyond offsets based on reduced or avoided emissions to offsets based on carbon removed from the atmosphere, such as Carbon Removal Certificates (CORCs).

There are two types of CO₂ compensation markets: compliance and voluntary. In a market like the European Union Emissions Trading System (EU ETS), companies, governments, or other entities purchase CO₂ offsets to comply with mandatory and legally binding limits on the total amount of carbon dioxide they are allowed to emit annually. Non-compliance with these mandatory limits within compliance markets results in fines or legal sanctions.

How It Started

According to the World Bank State and Trends 2020 Report, there are 61 carbon pricing initiatives in effect or planned for global implementation. These include both emissions trading schemes (such as cap-and-trade systems) and carbon taxes. While these initiatives represent carbon markets, not all of them include provisions for carbon offsetting. Instead, they place more emphasis on achieving emission reductions within the activities of regulated entities.

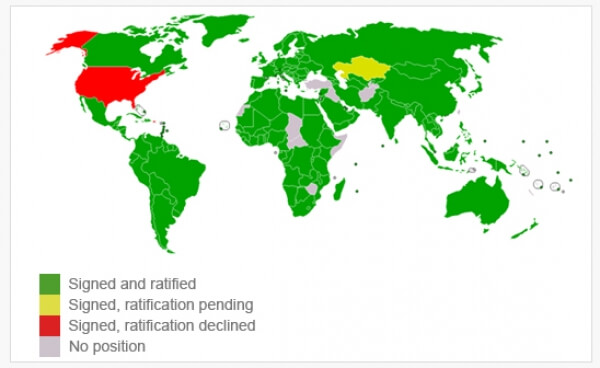

The original compliance carbon market was initiated by the Clean Development Mechanism (CDM) of the Kyoto Protocol. Signatories of the Kyoto Protocol agreed to mandatory emission reduction targets, facilitated (in part) by carbon offset purchases from low- and middle-income countries by higher-income countries, facilitated by the CDM.

The Kyoto Protocol was set to expire in 2020 and be succeeded by the Paris Agreement. Provisions in the Paris Agreement regarding the role of carbon offsets are still being determined through international negotiations, specifying the “Article 6” language. Compliance markets for carbon offsets include both international carbon markets developed through the Kyoto Protocol and the Paris Agreement, as well as domestic carbon pricing initiatives that incorporate carbon offset mechanisms.

With the increase in population and urbanization, there is a growing demand for CO₂ compensation. Within the voluntary market, the demand for CO₂ offset credits is generated by individuals, businesses, organizations, and subnational governments purchasing carbon offsets to reduce their greenhouse gas emissions to meet carbon-neutral, net-zero, or other established emission reduction goals.

The voluntary carbon market is facilitated by certification programs (e.g., Puro Standard, the Verified Carbon Standard, the Gold Standard, and the Climate Action Reserve) that provide standards and guidelines, establishing requirements that project developers must follow to generate CO₂ offset credits.

These programs generate CO₂ offset credits provided that an emission reduction or removal activity meets all program requirements, applies an approved project protocol (also known as a methodology), and successfully undergoes third-party verification. Once CO₂ offset credits are generated, any buyer can purchase them; for example, an individual might buy carbon offsets to compensate for emissions from air travel (see more about Air Travel and Climate).

There are various entities within the voluntary carbon market (such as kuwi.org). Carbon offset sellers, for instance, offer direct purchase of CO₂ offsets and often provide additional services, such as designating a carbon offset project to support or measure a buyer’s carbon footprint. In 2016, approximately €191.3 million worth of CO₂ offsets were purchased on the voluntary market, equivalent to about 63.4 million tons of CO₂e. In 2018 and 2019, the voluntary carbon market traded 98 and 104 million tons of CO₂e, respectively.

Compensations typically support projects that reduce greenhouse gas emissions in the short or long term. Common project types include renewable energy projects like wind farms, biomass energy, biogas digesters, or hydropower plants.

Others include energy efficiency projects such as efficient cookstoves, destruction of industrial pollutants or agricultural by-products, landfill methane destruction, and forestry projects. Some of the most popular CO₂ offset projects (from a corporate perspective) are energy efficiency and wind turbine projects.

Carbon removal offsets involve methods based on net-negative products and processes, such as biochar, carbonated building materials, and geologically stored carbon.

Sanctioned Offsets

The Kyoto Protocol sanctioned offsets as a means for governments and private companies to earn carbon credits that could be traded on the market. The protocol established the Clean Development Mechanism (CDM), which validates and measures projects to ensure they deliver genuine benefits and are truly “additional” activities that would not have otherwise been undertaken.

Organizations unable to meet their emission quotas can offset their emissions by purchasing CDM-approved Certified Emissions Reductions (CERs).

Offsetting can be a cheaper or more convenient alternative to reducing one’s own consumption of fossil fuels. However, some critics object to CO₂ offsets and question the benefits of certain types of offsets. Due diligence is recommended to assist businesses in assessing and identifying “high-quality” offsets, ensuring that offsetting provides the desired additional environmental benefits, and preventing reputation risks associated with low-quality offsets. Kuwi.org prioritizes compliance as the highest concern in its playbook.

Characteristics

Carbon offsets represent multiple categories of greenhouse gases, including carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), perfluorocarbons (PFCs), hydrofluorocarbons (HFCs), and sulfur hexafluoride (SF6).

Carbon offsets share several common characteristics:

Vintage:

The vintage is the year in which the CO2 reduction project generates carbon offset credits. Credit generation typically occurs after third-party assessment (verification) conducted by a validation-verification body (VVB) or designated operational entity (DOE) or other accredited external assessors.

Projects usually generate credits for emission-reducing activities or practices that have been measured and only after third-party assessment. However, there is a practice called “Forward Crediting” used by a limited number of programs where credits may be granted for expected emission reductions that the project developer anticipates.

This practice carries the risk of issuing too many credits if the project fails to realize the estimated impact and allows credit buyers to claim emission reductions in the present for activities that have not yet occurred.

Project Type:

The project type refers to the modification implemented (i.e., the technology or practice used) to reduce emissions through the project. Projects can include land use (e.g., improved forest management), methane capture, biomass sequestration, renewable energy, industrial energy efficiency, and more.

Co-benefits:

In addition to reducing greenhouse gas emissions, projects can provide benefits such as ecosystem services or economic opportunities for communities near the project location. These project benefits are called “co-benefits.” For example, projects reducing greenhouse gas emissions in agriculture may improve water quality by reducing fertilizer use, which can lead to runoff and water pollution.

Certification Regime:

The certification regime describes the systems and procedures used to certify and register carbon offsets. Various methods are used to measure and verify emission reductions, depending on the type, size, and location of the project. For instance, the Clean Development Mechanism (CDM) distinguishes between large and small-scale projects.

In the voluntary market, there are different industry standards, including the Verified Carbon Standard, Plan Vivo Foundation, and the Gold Standard, implemented to provide third-party verification of carbon offset projects. Puro Standard, the first standard for technical carbon removal, has been verified by DNV GL.

The Gold Standard requires delivery and verification of sustainable development benefits in addition to emission reductions. There are also some additional standards for the validation of co-benefits, including the CCBS issued by Verra and the Social Carbon Standard issued by the Ecologica Institute.

Criteria for Quality Offsets

The accounting of offsets can involve the following fundamental areas:

1. Baseline and Measurement:

– What emissions would occur if there were no proposed project?

– How are emissions measured after the project has been implemented?

2. Baseline and Measurement:

– Would the project still occur without the investment generated by the sale of CO₂ offset credits?

There are two common reasons why a project may lack additionality: (a) if it is intrinsically financially worthwhile due to energy cost savings, and (b) if it had to be implemented due to environmental laws or regulations.

3. Sustainability:

– Are some benefits of the reductions reversible?

– For example, trees may be cut down for wood burning, and does growing trees for firewood reduce the need for fossil fuels?

If the surface area or density of forests increases, carbon is sequestered. After about 50 years, forests start to mature, removing carbon dioxide more rapidly than a recently replanted forest area.

4. Leakage:

– Does the implementation of the project cause higher emissions outside the project boundary?

5. Co-benefits:

– Are there additional benefits besides the reduction of CO₂ emissions, and to what extent?

These criteria are essential for evaluating the quality and effectiveness of carbon offset projects. Rigorous assessment and verification processes, often conducted by third-party organizations, are crucial to ensuring that offsets meet high standards and genuinely contribute to emissions reductions and broader sustainability goals.

Additional Benefits

While the primary goal of carbon offsetting is to reduce global carbon emissions, many offset projects claim to bring about improvements in the quality of life for local populations. These additional improvements are referred to as co-benefits and can be considered when evaluating and comparing CO₂ offset projects. Possible co-benefits of a project replacing wood stoves with ovens using less carbon-intensive fuel, for example, could include:

1. Reduced Pollution:

Less non-greenhouse gas pollution (smoke, ash, and chemicals), improving indoor air quality and health..

2. Improved Forest Conservation:

Better preservation of forests, which are crucial habitats for wildlife.

Carbon offset projects can also lead to co-benefits such as improved air and water quality and healthier communities.

In a recent study conducted by EcoSecurities, Conservation International, CCBA, and ClimateBiz, over 77 percent of the 120 surveyed companies identified community and environmental benefits as the primary motivator for purchasing CO₂ offsets.

By putting a price on carbon, innovation is encouraged by providing funding for new ways to reduce greenhouse gases across various sectors. Carbon reduction goals drive demand for offsetting and carbon trading, fostering the growth of this new industry and offering opportunities for different sectors to develop and adopt innovative new technologies.

Carbon offset projects also result in savings—energy efficiency measures can reduce fuel or electricity consumption, potentially leading to lower maintenance and operational costs.

The UNFCCC has established a dedicated website where CDM activities and pre-consideration projects on a voluntary basis can report their co-benefits.